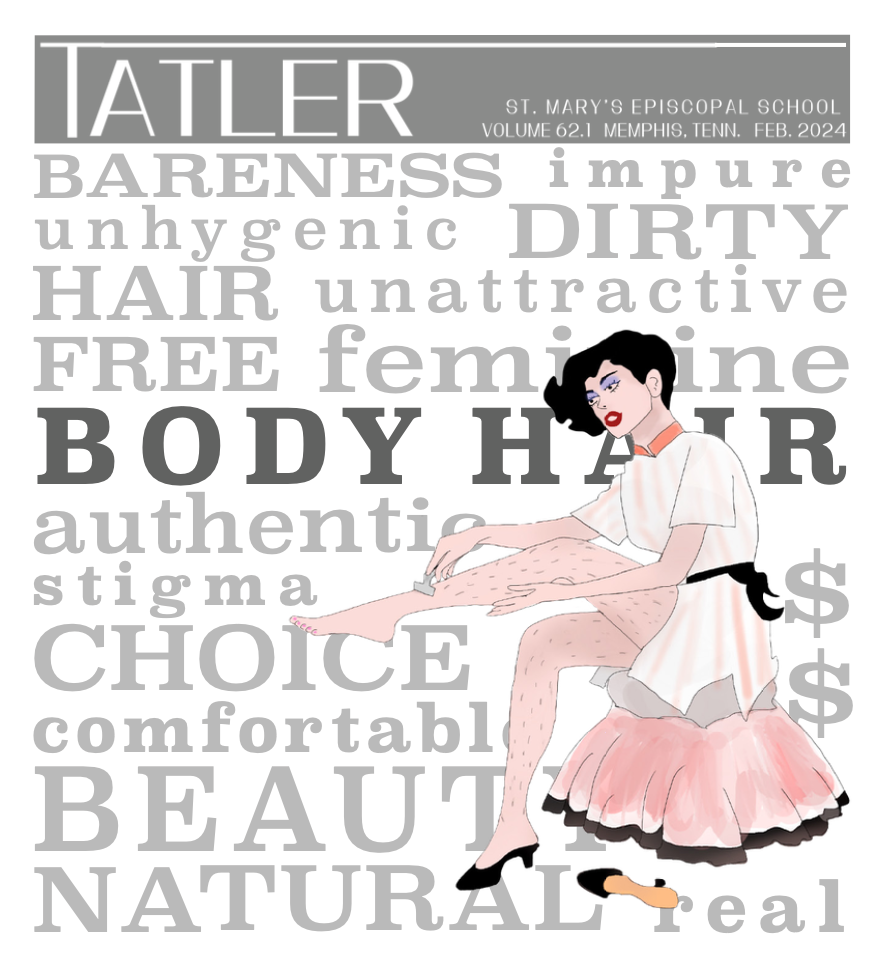

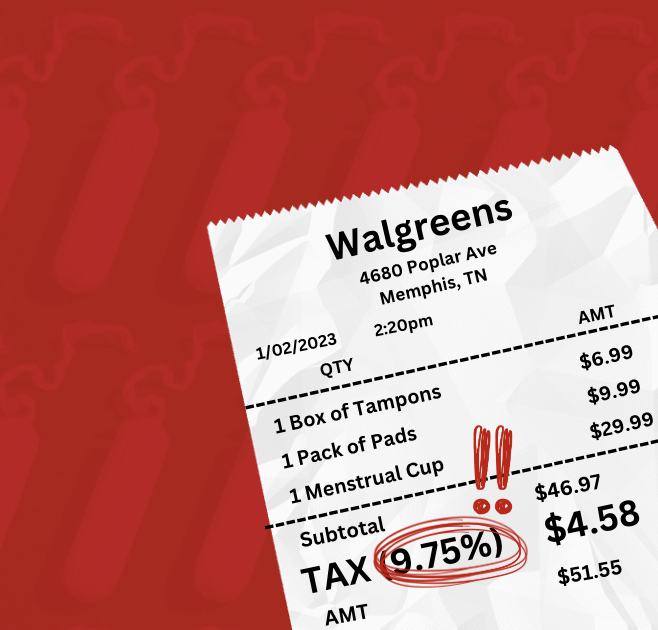

Have you ever looked at your receipt after buying pads or tampons? We have and were no less than shocked. With further inspection, one number sticks out in particular: 9.75%. That is the combined state and local sales tax charged on period products in Memphis, Tenn.

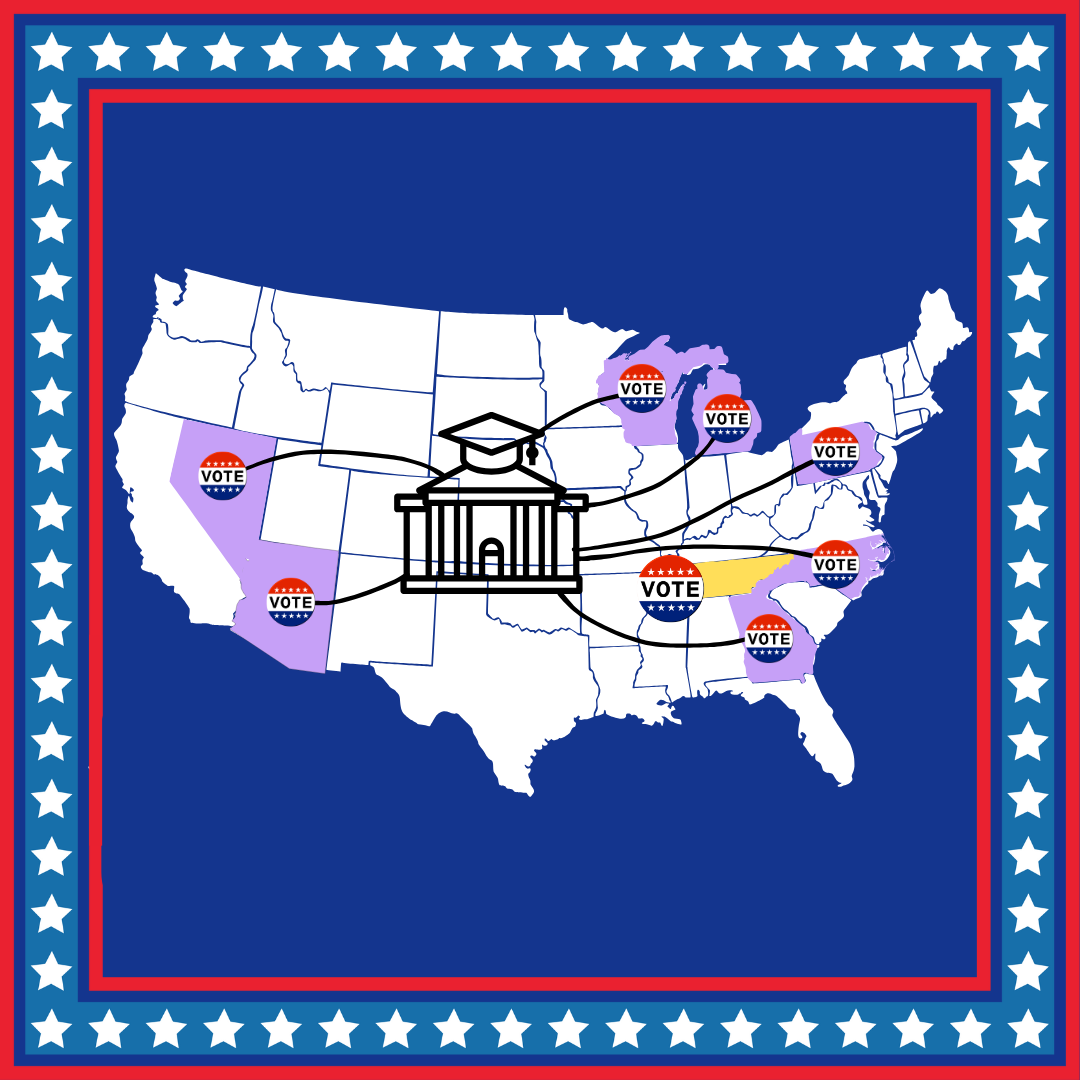

Tennessee is one of 21 U.S. states to still enforce a standard sales tax on menstrual products – including pads, tampons and menstrual cups – a practice sometimes called the tampon tax. These products are charged with a 7% state tax plus a 2.75% local sales tax in Memphis because, according to the Tennessee government, they are non-essential, unlike food and fuel.

Wrong. Tampons are essential. Pads are essential. Cups are essential. Period underwear is essential.

Like food or fuel, menstrual products are necessary to go to work or school, to have good hygiene and to participate in the full range of human activities. If menstrual products serve a similar purpose to basic essentials, then they should be treated and taxed as such.

To make matters worse, Tennessee has one of the highest sales taxes in the country, making it even more difficult for people who menstruate in Tennessee to afford a necessity.

The Tennessee state legislature has discussed this very topic many times but has taken no action.

When the inclusion of period products in Tennessee’s annual tax-free weekend was proposed in 2020, Republican Sen. Joey Hensley of Hohenwald, Tenn. found fault with the plan, claiming that women would take advantage of this opportunity and buy in bulk. As a result of voices like his, the 2020 tax-free weekend, like all the others before it, excluded menstrual products from the tax exemption.

But Tennessee state officials are still talking taxes. Another tax proposal went through the Tennessee legislature in 2023 about creating a 91-day tax exemption on food and food ingredients. This bill passed through the Senate without much resistance.

State officials, including Hensley, supported forgoing tax revenue for three months worth of taxes on food, which is great for many Tennesseeans, but outrageous when contrasted with the refusal of a mere three-day tax-free interval for period products.

When it came to period products, the Tennessee House of Representatives (which is 90% male) responded with a hard no. But steaks and potatoes? Those are served with a side of tax exemption.

According to the Alliance for Period Supplies, one in three low-income people in the U.S. have missed school or work due to insufficient funds for period products. In Tennessee, one in five women and girls aged 12 to 44 fall below the federal poverty line, creating significant period poverty throughout the state.

Without access to adequate period products, people are forced to use unhygienic backups like rags, paper towels, toilet paper or cardboard, which simply aren’t meant to serve that purpose. If they bleed through their clothes, they have to go home and miss school or work.

Other victims of period poverty may use products longer than the recommended time, which increases the risk of infections like urinary tract infections, bacterial vaginosis and toxic shock syndrome.

All of this is happening in Tennessee because officials want to keep profiting from tampons. (The tax on period products is 0.05% of their total revenue). But 24 states have been willing to forego this revenue, and they are doing just fine.

Period products are taxed in Tennessee. It sucks. But we can do something about it.

One option is to be deliberate when voting for elected officials and ensure that they believe period products are essential and should not be taxed. If you want to take a more direct approach, try emailing your lawmakers and expressing your opinion.

If you are looking to volunteer your time or money, there are plenty of non-profit organizations looking for help to work against the tampon tax. CVS is also attempting to fight the tampon tax by covering the tax in 12 states, including Tennessee, that still deem tampons as non-essential goods. We recommend buying period products from CVS instead of other drugstore chains.

And if you are looking for a five-minute fix and a way to save thousands, the answer is simple: buy a menstrual cup from CVS. One can last up to ten years, which means zero exposure to tampon taxes and may save you up to $2,300 over the lifetime of the cup.

It’s bloody well time that the tampon tax dies.

![[GALLERY] Walking in (Downtown) Memphis](https://stmarystatler.org/wp-content/uploads/2024/04/E1DAD3FE-E2CE-486F-8D1D-33D687B1613F_1_105_c.jpeg)